All Categories

Featured

Table of Contents

For making a restricted amount of the index's development, the IUL will certainly never ever get much less than 0 percent passion. Even if the S&P 500 declines 20 percent from one year to the following, your IUL will certainly not shed any cash value as a result of the marketplace's losses.

Envision the rate of interest worsening on a product with that kind of power. Given all of this details, isn't it conceivable that indexed global life is an item that would allow Americans to buy term and invest the remainder?

A true investment is a securities item that undergoes market losses. You are never based on market losses with IUL just because you are never subject to market gains either. With IUL, you are not purchased the marketplace, but just earning passion based on the performance of the market.

Returns can expand as long as you proceed to make repayments or keep an equilibrium.

Indexed Universal Life Insurance Companies

Unlike universal life insurance policy, indexed global life insurance policy's cash worth gains rate of interest based upon the efficiency of indexed securities market and bonds, such as S&P and Nasdaq. Remember that it isn't directly bought the securities market. Mark Williams, Chief Executive Officer of Brokers International, discusses an indexed universal life plan resembles an indexed annuity that seems like global life.

Universal life insurance was produced in the 1980s when rate of interest rates were high. Like other kinds of permanent life insurance coverage, this policy has a cash money value.

Indexed global life policies supply a minimal guaranteed interest rate, additionally known as a rate of interest crediting floor, which minimizes market losses. State your money worth loses 8%.

Single Premium Indexed Universal Life

A IUL is an irreversible life insurance plan that obtains from the homes of an universal life insurance coverage plan. Unlike universal life, your cash value grows based on the efficiency of market indexes such as the S&P 500 or Nasdaq.

Her job has been released in AARP, CNN Highlighted, Forbes, Lot Of Money, PolicyGenius, and U.S. Information & World Record. ExperienceAlani has actually examined life insurance policy and family pet insurance policy business and has actually written numerous explainers on traveling insurance policy, credit score, financial debt, and home insurance. She is enthusiastic concerning demystifying the complexities of insurance policy and various other personal finance subjects so that readers have the info they need to make the very best cash choices.

Paying just the Age 90 No-Lapse Premiums will guarantee the death advantage to the insured's attained age 90 yet will certainly not guarantee cash worth build-up. If your client ceases paying the no-lapse assurance costs, the no-lapse function will certainly end before the ensured period. If this occurs, additional costs in a quantity equal to the shortage can be paid to bring the no-lapse feature back effective.

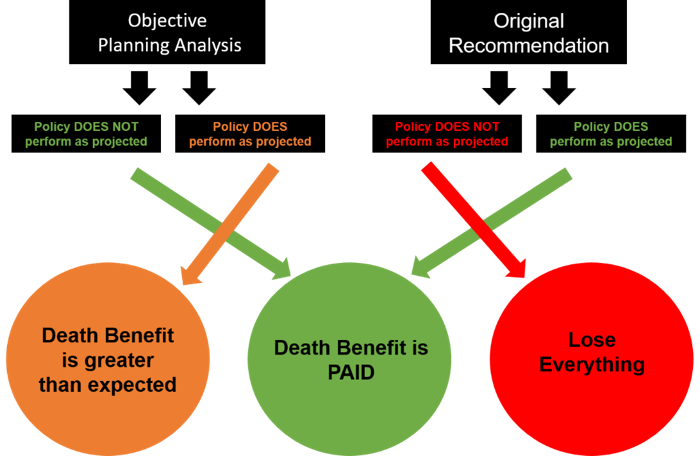

I just recently had a life insurance policy salesman appear in the comments thread of a message I released years ago concerning not blending insurance policy and investing. He thought Indexed Universal Life Insurance Coverage (IUL) was the finest point since cut bread. On behalf of his placement, he posted a web link to a write-up composed in 2012 by Insurance Representative Allen Koreis in 2012, entitled "16 Reasons Accountants Prefer Indexed Universal Life Insurance Policy" [link no longer available]

No Load Universal Life Insurance

First a quick explanation of Indexed Universal Life Insurance Coverage. The tourist attraction of IUL is obvious. The premise is that you (practically) get the returns of the equity market, without any risk of shedding cash. Currently, prior to you drop off your chair poking fun at the absurdity of that statement, you need to understand they make a really persuading disagreement, at the very least up until you take a look at the information and realize you don't get anywhere near the returns of the equity market, and you're paying much way too much for the warranties you're obtaining.

If the marketplace drops, you obtain the guaranteed return, normally something in between 0 and 3%. Naturally, given that it's an insurance plan, there are additionally the usual costs of insurance, commissions, and abandonment fees to pay. The information, and the factors that returns are so terrible when mixing insurance and investing in this certain way, boil down to essentially 3 things: They only pay you for the return of the index, and not the rewards.

Iul Cost

If you cap is 10%, and the return of the S&P 500 index fund is 30% (like last year), you obtain 10%, not 30%. If the Index Fund goes up 12%, and 2% of that is returns, the adjustment in the index is 10%.

Add all these impacts together, and you'll locate that lasting returns on index global life are pretty darn near those for whole life insurance coverage, positive, but reduced. Yes, these plans assure that the cash worth (not the cash that goes to the costs of insurance, of course) will not lose money, however there is no warranty it will stay up to date with rising cost of living, a lot less expand at the rate you need it to expand at in order to attend to your retirement.

Koreis's 16 factors: An indexed global life policy account worth can never shed cash due to a down market. Indexed global life insurance policy warranties your account value, securing gains from each year, called a yearly reset. That's real, but only in small returns. Ask yourself what you require to pay in order to have a guarantee of no nominal losses.

In investing, you make money to take threat. If you do not wish to take much danger, don't expect high returns. IUL account worths grow tax-deferred like a certified strategy (IRA and 401(k)); mutual funds don't unless they are held within a certified plan. Basically, this means that your account worth benefits from triple compounding: You gain passion on your principal, you gain rate of interest on your rate of interest and you make passion on the money you would certainly otherwise have paid in tax obligations on the rate of interest.

Insurance Company Index

Qualified strategies are a much better option than non-qualified strategies, they still have concerns not offer with an IUL. Investment selections are generally restricted to shared funds where your account value is subjected to wild volatility from exposure to market danger. There is a large distinction between a tax-deferred retired life account and an IUL, but Mr.

You purchase one with pre-tax bucks, saving on this year's tax costs at your minimal tax obligation price (and will certainly frequently be able to withdraw your cash at a lower efficient price later) while you buy the various other with after-tax dollars and will certainly be forced to pay rate of interest to borrow your very own cash if you don't wish to surrender the policy.

Then he throws in the traditional IUL salesman scare technique of "wild volatility." If you hate volatility, there are better ways to lower it than by acquiring an IUL, like diversification, bonds or low-beta supplies. There are no limitations on the amount that might be added each year to an IUL.

Why would certainly the federal government placed restrictions on how much you can place right into retirement accounts? Perhaps, simply perhaps, it's because they're such a great bargain that the federal government does not want you to save too much on taxes.

Latest Posts

Can I Cash Out My Universal Life Insurance Policy

Universal Life Insurance With Living Benefits

Nationwide Universal Life